Advising generally on accounting issuesĬompanies sometimes also appoint an independent financial adviser to assist them with the IPO process, including managing appointments of underwriters and lead managers and providing an independent perspective on their advice.Ĭompany will need to engage a registry to handle the receipt and processing of applications and the establishment and management of the share register.Ĭompany may wish to engage a public relations consultant to assist with publicising and marketing the offer.Ĭompany will need to engage US legal counsel if an offer is to be made into the United States and New Zealand legal counsel if shares will be offered to retail investors in New Zealand.Ĭompanies operating in speciality industries such as mining and property may need to commission specialist experts to advise on and prepare specialist reports.Ĭompany will also need to engage a printer, designer and typesetter to assist with the prospectus. Participating as a member of the DDC and providing a sign-off to the DDC on the financial information. Preparing an investigating accountant’s report for inclusion in the prospectus. Conducting a review of the financial information contained in the prospectus (including a review of the forecasts and underlying assumptions) and tax due diligence. Assisting the company with preparing accounts and financial disclosure in the prospectus. Either underwriting the offer (by agreeing to acquire shares not taken up) or simply managing the offer (which usually involves the provision of “settlement support” in respect of investors who default on their settlement obligations). Advising on the best method of marketing, the size of the issue, the timing and price. Marketing to investors (including accompanying the entity’s management on roadshow presentations). Evaluating and keeping the entity informed of current market conditions and assessing the likely level of demand for the entity’s securities. Advising on the entity’s capital structure, dividend policy and board composition. Advising on the structuring of the offer. Providing tax advice on structuring the offer (including any sell down by existing shareholders, including employees) and assisting on tax disclosures in the prospectus. Co-ordinating the listing application with ASX, lodging the prospectus with ASIC and seeking any other necessary regulatory approvals.

Assisting the entity with drafting and negotiating the underwriting agreement with the lead manager/underwriter and its counsel.Carrying out legal due diligence, including reviewing any material contracts and preparing a report for the DDC.Participating as a member of the DDC and providing a legal sign-off to the DDC that, among other things, the prospectus is not misleading or deceptive and that an appropriate due diligence process has been carried out.

Advising on the entity’s board composition and corporate governance.

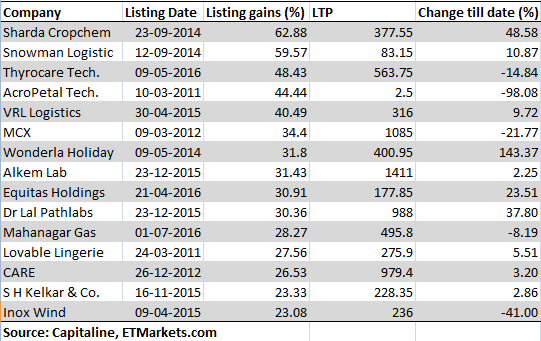

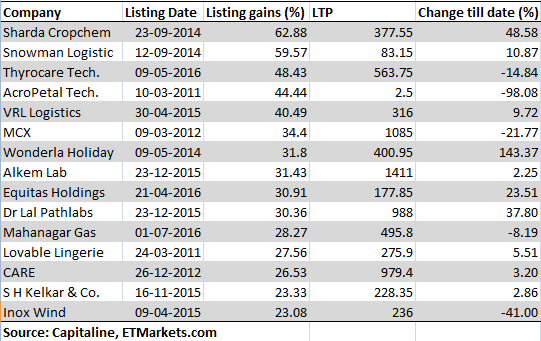

#ASX RECENT IPOS VERIFICATION#

Advising on all Australian legal aspects of preparing for listing (including the establishment of a due diligence process, assisting with the preparation of the prospectus, supervising verification of the prospectus and pre-listing corporate restructuring matters).

0 kommentar(er)

0 kommentar(er)